Emerging markets: have they really decoupled from the rest of the world

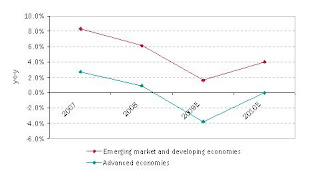

To answer this question one would have to look at what exactly is decoupling. Decoupling, as has been defined in the traditional sense, means the ability of emerging countries to grow without any stimulus from developed countries, primarily the United States. The April 2009 World Economic Outlook by International Monetary Fund (IMF) seems to support this phenomenon. According to the April 2009 World Economic Outlook by IMF, emerging market and developing countries outgrew the advanced nations in 2007 and 2008. Further, the report expects advanced economies to contract by 3.8% y-o-y in 2009 (United States to contract by 2.8% y-o-y) and growth is expected to remain flat in 2010. This compares with a +1.6% y-o-y and +4.0% y-o-y growth estimated for the emerging market and developing countries in 2009 and 2010 respectively. The world economic conditions have since improved, and the forecasts are expected to improve when IMF comes out with its revised forecast in autumn, but what remains the key take-away here is the fact that emerging market growth has outperformed the advanced countries in the past and the trend is expected to continue going forward.

World output growth 2007 – 2010

To answer this question one would have to look at what exactly is decoupling. Decoupling, as has been defined in the traditional sense, means the ability of emerging countries to grow without any stimulus from developed countries, primarily the United States. The April 2009 World Economic Outlook by International Monetary Fund (IMF) seems to support this phenomenon. According to the April 2009 World Economic Outlook by IMF, emerging market and developing countries outgrew the advanced nations in 2007 and 2008. Further, the report expects advanced economies to contract by 3.8% y-o-y in 2009 (United States to contract by 2.8% y-o-y) and growth is expected to remain flat in 2010. This compares with a +1.6% y-o-y and +4.0% y-o-y growth estimated for the emerging market and developing countries in 2009 and 2010 respectively. The world economic conditions have since improved, and the forecasts are expected to improve when IMF comes out with its revised forecast in autumn, but what remains the key take-away here is the fact that emerging market growth has outperformed the advanced countries in the past and the trend is expected to continue going forward.

World output growth 2007 – 2010

Source: IMF, April 2009 World Economic Outlook

Given the above facts is it prudent to conclude that the decoupling has indeed happened? And if indeed it has then what are the factors behind it?

Economic liberalization and globalization have been the key words in the world economic scenario for the past two decades and has let to a number of benefits, especially for the developing economies in the form of increased economic activity and improvement in the standard of living. Improved economic conditions and standard of living in turn has driven domestic demand within the developing countries, a form of shield for the developing countries from the broader negative happenings across the world - decoupling (although not in entirety).

Considering the base of decoupling itself lies in globalization how long can the emerging markets/developing nations continue to grow when the advanced nations are reeling under economic weakness. It is possible in the near term for the developing countries, especially India and China, to grow based on strength of domestic demand and mitigate the impact of global weakness but the long term success of any economy in today’s world of globalization is linked and entwined. The plummeting of equity indices around the world, including those of the emerging markets, post the financial crisis in United States is proof of the growing dependence of nations on one another. Prolonged global crisis would mean declining exports, drying- up of foreign investments and reduced cross-border lending. Reduced investments and exports would mean liquidity issues even for domestic companies, reduced economic output, rising unemployment, slowdown in the domestic economy and rising deficits. Besides, with reduced inflow of money and rising deficits, implementing fiscal policies would become very difficult for governments of developing nations. Thus to say that emerging markets have decoupled would be jumping to conclusion too soon. Having said that it would also be impertinent to totally ignore the strength of some of the emerging countries, particularly China, where government stimulus and spending is almost on par with some of the developed nations and is driving demand growth not only domestically but even in some sectors of the United states. So instead of arguing over if emerging economies have decoupled, a better idea would be to accept that a few of the developing nations are coming into their own, and if not dependence of emerging countries on the United States, in future it could be dependence on United States and China or dependence on China instead of United states. For now the dependence continues to exist and it is not only of the developing nations on some other nation but dependence of economies on one another, be it of the developing nations or of the developed nations.

-Shazia Naik

(Dated: 04 July 2009)

4 comments:

'good write-up'

informative...nice and simple

a very comprehensive writeup....good one keep up the good work

very interesting. Keep up the good work.

Post a Comment