Will Mallya have the last laugh?

Everyone

seems to be talking about Kingfisher Airlines Ltd. (KFA) and Vijay Mallya these

days…on how hopeless KFA is and how Mallya will possibly have to sell his other

assets to raise money to appease KFA lenders and keep the airline operational.

But is this really the end of ‘Good Times’ for ‘King’ Mallya or are we jumping

the gun in labeling him as a goner? Let’s look at the facts:

Everyone

seems to be talking about Kingfisher Airlines Ltd. (KFA) and Vijay Mallya these

days…on how hopeless KFA is and how Mallya will possibly have to sell his other

assets to raise money to appease KFA lenders and keep the airline operational.

But is this really the end of ‘Good Times’ for ‘King’ Mallya or are we jumping

the gun in labeling him as a goner? Let’s look at the facts:

Once

amongst the top domestic carriers in India, grounded flights, layoffs

etc resulted in KFA’s market share dipping from over 15% in 2011 to 3% in July 2012and spiraling losses for the

company. The airline cut down its operations from 66 aircrafts in 2011 to 12-13

in 1H 2012 and now only 7 are operational. Financials pose even a more grim picture. As of FY 2012, the company has a debt of Rs8,030cr (short term

debt is 2,335) + over Rs 1,300 crs in current liabilities in addition to

payables to airport operators and exchequer. Increasing loss for the company during the year just adds to the gloom. According to an August 2012 study on ‘Analysis of Indian carriers Q1-FY13 performance’ published

by The Centre for Asia Pacific Aviation, KFA requires

about $600mn by October 2012 and a further $400mn over the next 12-18 months to

save the company. As the 17-member banking consortium led by State bank of

India (SBI), which loaned about Rs.7,000crs to KFA seems to be closing in, the key

question on everyone’s minds seems to be- Where does this leave Mallya?

One positive for Mallya seems to be that after a long drawn wait,

the government has finally opened up FDI in aviation of upto 49% in the second

week of Sept 2012. This opens up one avenue for Vijay Mallya. But with the

current state of the airline (high debt, huge losses, minimal mkt share,

curtailed operations) it will hardly be a surprise if foreign players are

averse to investing money in KFA. Just for the sake of simplicity even if we

assume that some player is ready to invest in money at current market price of Rs14.45

it will still raise about Rs572crs. At a higher price of Rs20-25 the amount

raised would still be between Rs800-1000crs, quite below the required levels.

Another option would be selling non-core assets such as Mangalore

Chemicals and Fertilizers Ltd. (Mangalore Chemicals). Vijay Mallya has a stake

of about 30% in this company. At CMP of Rs14.45 the stake is valued at about Rs.177crs,

far less than the required amount. Even if we assume that the stock price

increases considerably, the stake sale would not garner enough by itself to

meet KFA’s obligatory amount.

For that matter, the yields from both the above measures combined

(FDI in KFA plus a stake sale in Mangalore chemicals) would still be significantly

below of the amount required by KFA or Mallya in the near term.

In case KFA is unable to raise the required capital in time

lenders will resort to selling of non-core assets (as is being currently

planned) as well as corporate guarantees of United Breweries Holdings Ltd.

(UBH) will be called upon. UBH itself has Rs2,122crs in debt compared to

Rs4,710crs in assets and of these assets 20% are invested in KFA. With limited

scope for repayment of its own debt or KFA guarantees, stake sale in holdings

seem to be only option out. We have already discussed how selling of non-core

assets will not yield sufficient capital and FDI is also not a viable option

(atleast till Mallya injects some capital into his airline), hence the

remaining option is selling stake in United Breweries Ltd. (United Breweries)

or United Spirits Ltd. (United Spirits).

Let’s look at both these avenues in terms of risk that Mallya

faces. Currently about 7.56% shares or 10% of promoter’s stake of United Breweries

is pledged. Compare this to United Spirits where 97.32% of UBH’s stake of

18.03% and 100% of Kingfisher Finvest’s stake of 9.69% is pledged. In short,

98% of promoter’s equity is pledged. In case of any event default in debt

servicing, 98% of promoter’s stake in United Spirits will be at risk- a

possibility of Mallya ceasing to be the controlling stakeholder of the company.

In view of this we believe that United Spirits can better serve as the vehicle

to drive mallya to safe shores.

A positive way of looking at solving the current crisis would be….

at current market price of Rs1,147.7, the United Spirits’ pledged amount would

be valued at Rs4,085 crs. Hence, selling of stake in United Spirits could, I

believe, create a win-win situation for all concerned. As per news reports, Diageo

Plc (Diageo), the world’s largest spirit company, is looking at buying a stake

in United Spirits. It is looking at a valuation of Rs1,200-1,300 per share

while United Spirits is looking at a Rs1,400-1,600 price level. Diageo is also

willing to retain Mallya as the chairman for life even if it gains a majority

stake in United Spirits. At the above mentioned price range of Rs1,200-1,600

per share, even a stake sale of 15% would yield Rs2,354-3,139crs, there by

solving Mallya’s near term worries. It would also leave him with a remaining stake

of 13% in United Spirits, to enjoy the future growth of the company, as well as

allowing him to continue as the chairman of United Spirits. United Spirits

stands to benefit from synergy and new avenues of growth and funding brought to

the table by global giant Diageo. With respect to Diageo, apart from the

anticipated 15% stake from Mallya, the company is also expected to raise another

10% from other investors making it the largest shareholder in United Spirits and

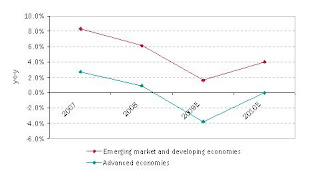

giving it a foothold in the key market of India which is expected to grow by 5-6%

in volume terms, the fastest in emerging markets as India benefits from growing population and per capita income levels (Source: International

Wine and Spirit Research).

With the required cash in hand Mallya can appease the lenders in

the upcoming KFA lenders meeting (to be held in 1H Oct 2012), draw plans to

restructure the airline and work on getting an FDI partner for KFA at better

valuations.

The United Spirits stock has increased about 22% in the past 1

month and 134% Ytd while United Breweries has risen about 26% in the past 1

month and 84% Ytd. The KFA stock has increased about 55% in the past 1 month (Ytd:

-31%). Additionally, UBH has increased about 35% in the past 1 month and 121% Ytd.

In view of the above mentioned factors I believe that the United

Spirits stock could surge higher from current price levels either due to

speculation on the stake sale or

re-rating due to change in fundaments (in actual event of a stake sale).

Consequently, we could see further upside in the KFA and UBH stocks from

current levels in the near term. The good

times remain for Mallya..for now...

Please note: The Current market Price (CMP)

is BSE last traded price as of 25 Sept 2012. 1 month and YTD figures courtesy

google finance. Picture courtesy google images.